April marks the start of the busy season in real estate. If you are considering buying or selling there are four points to keep in mind about the 2025 spring market.

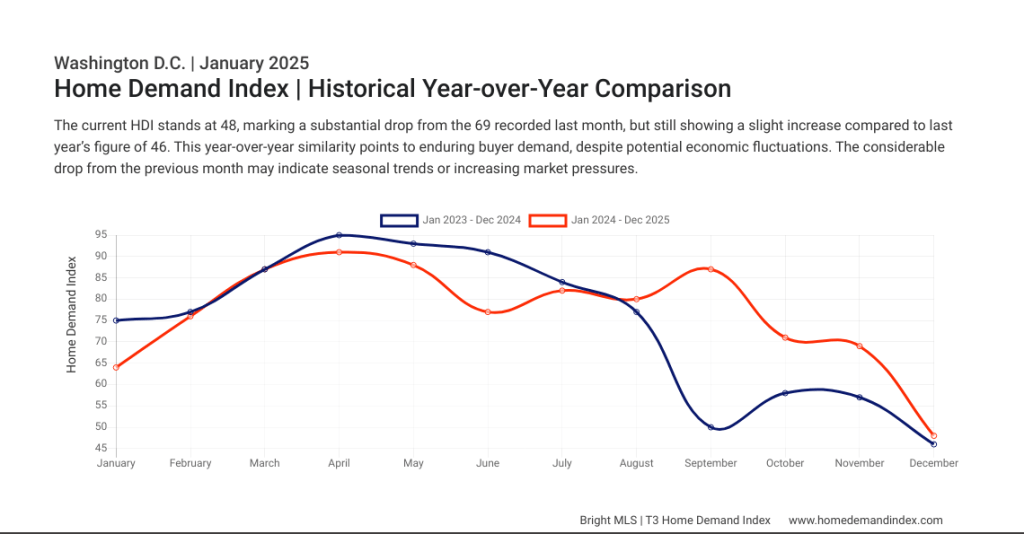

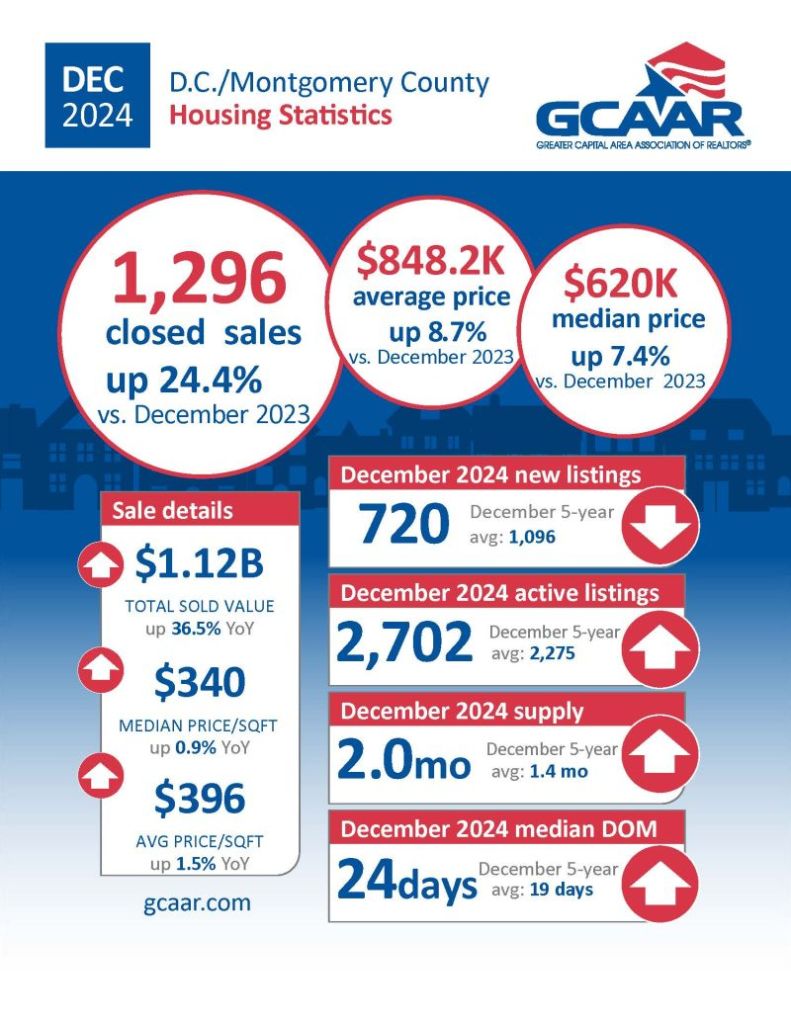

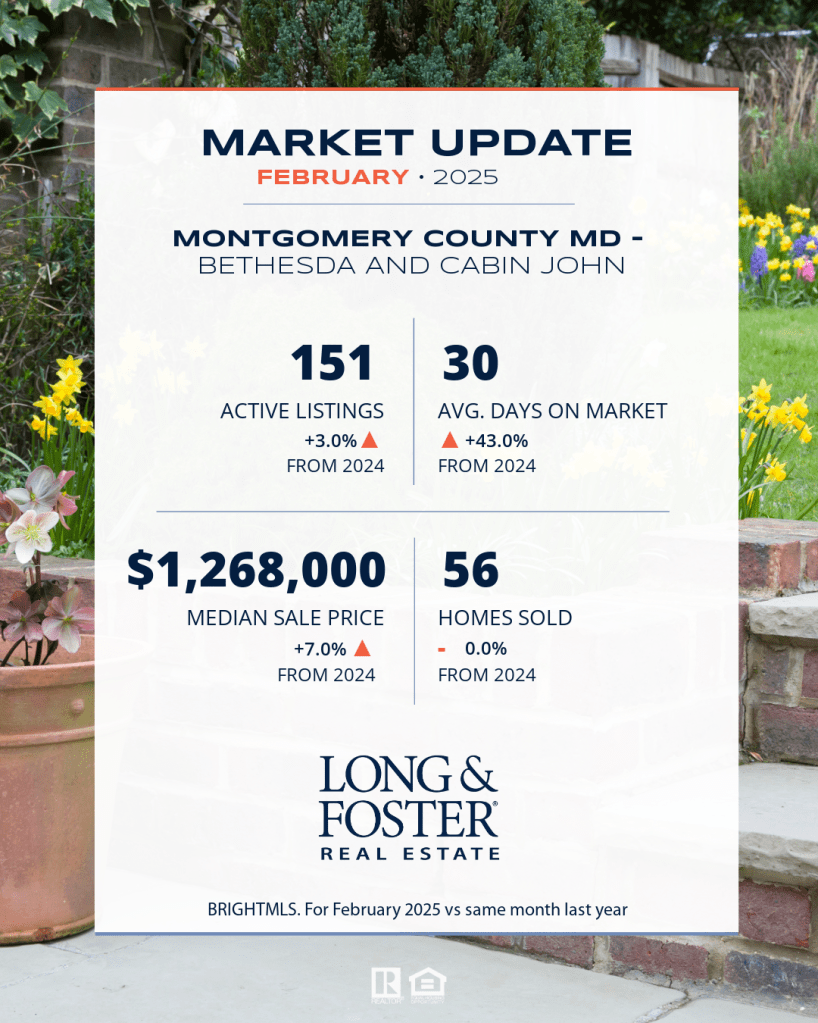

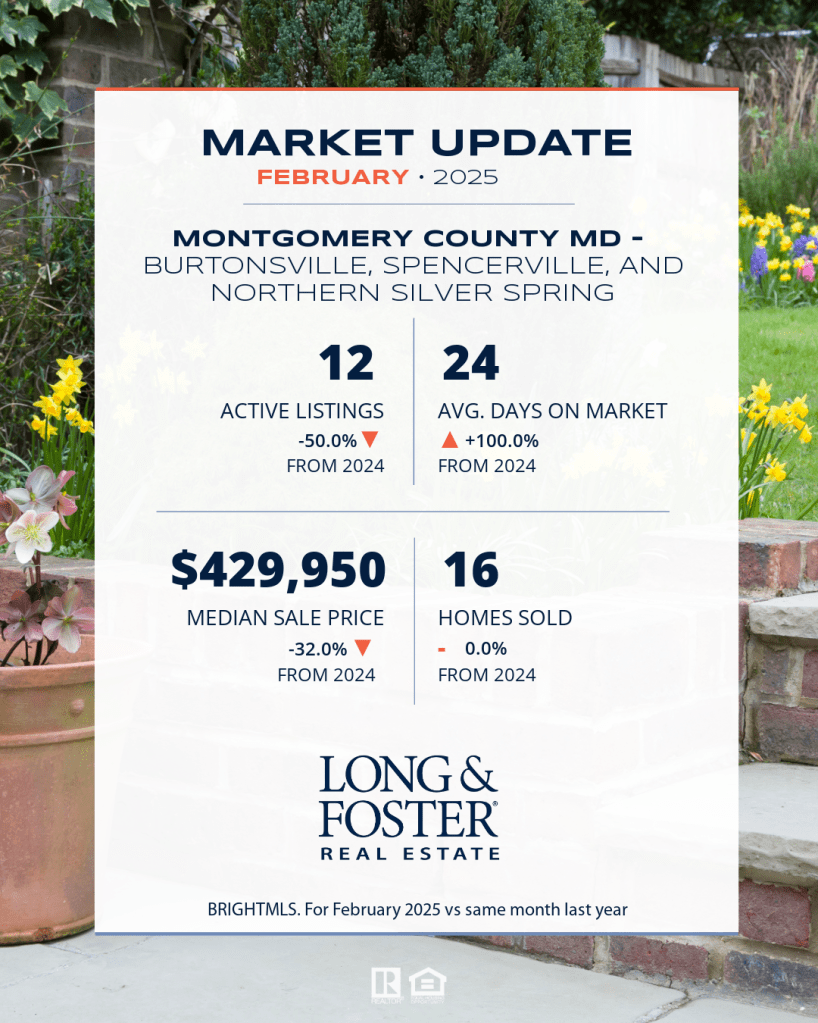

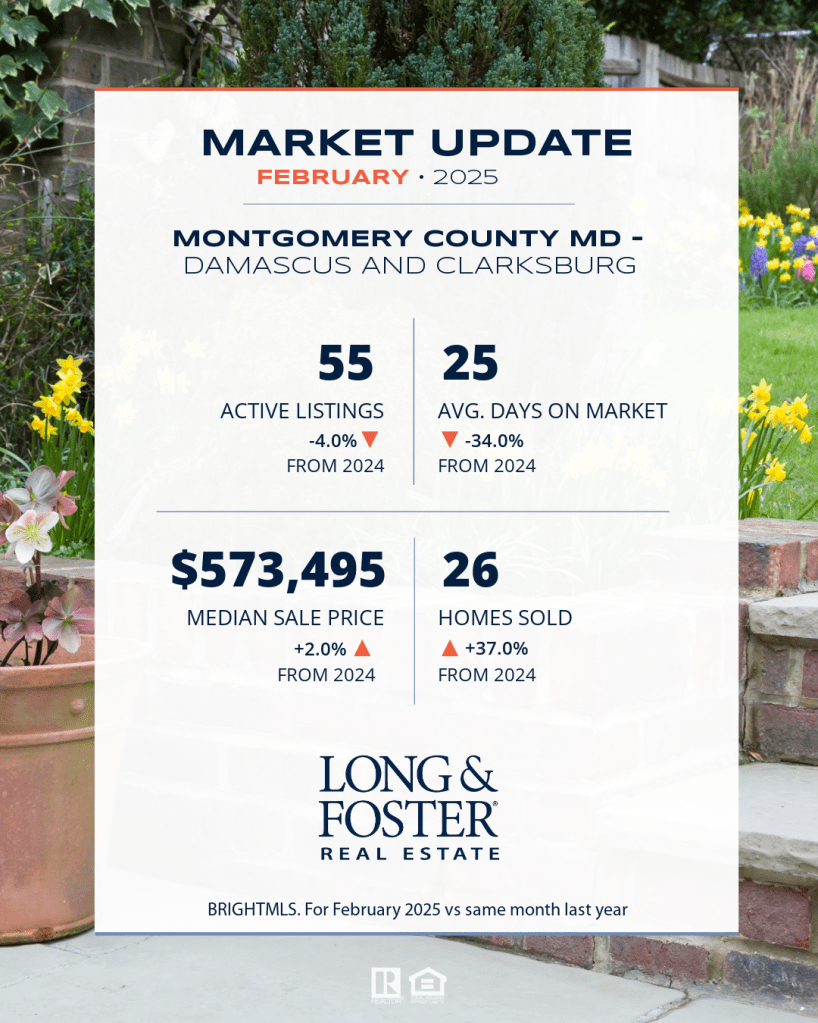

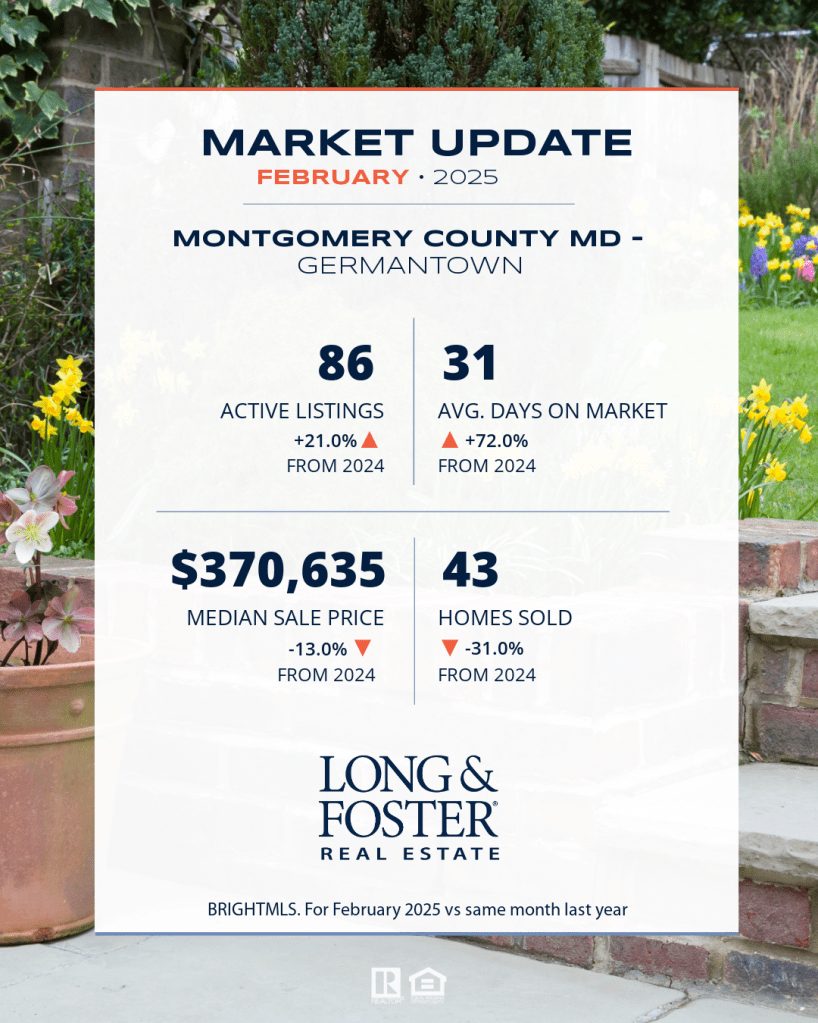

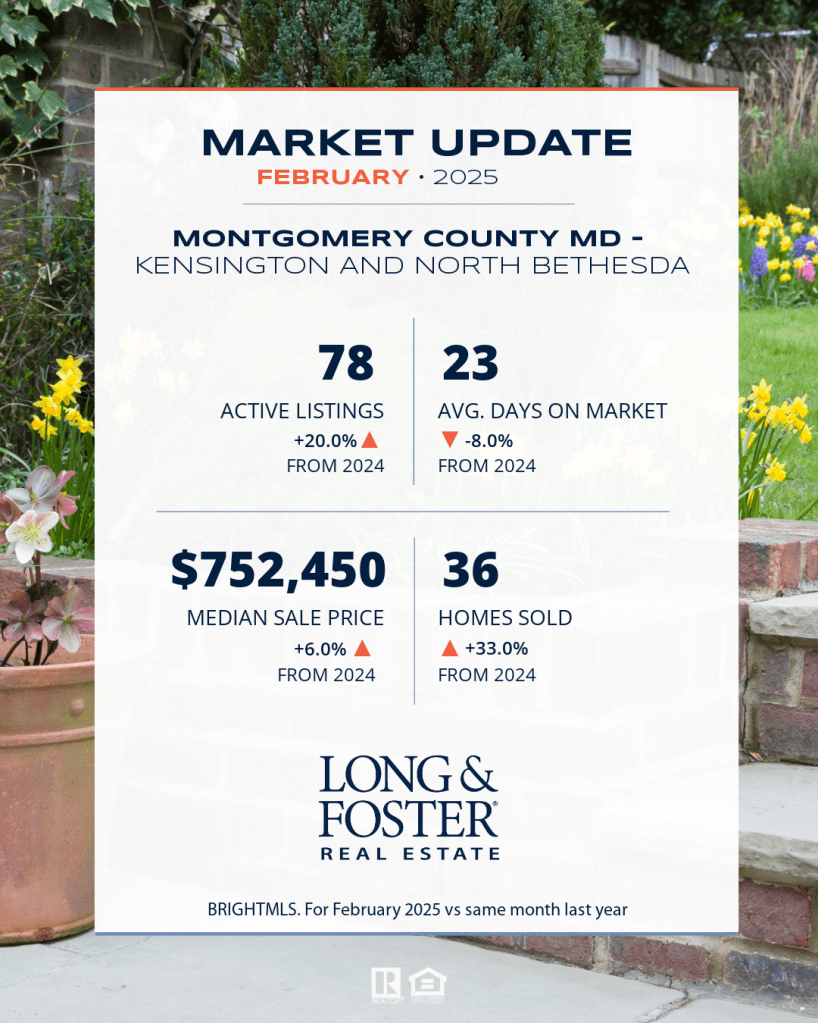

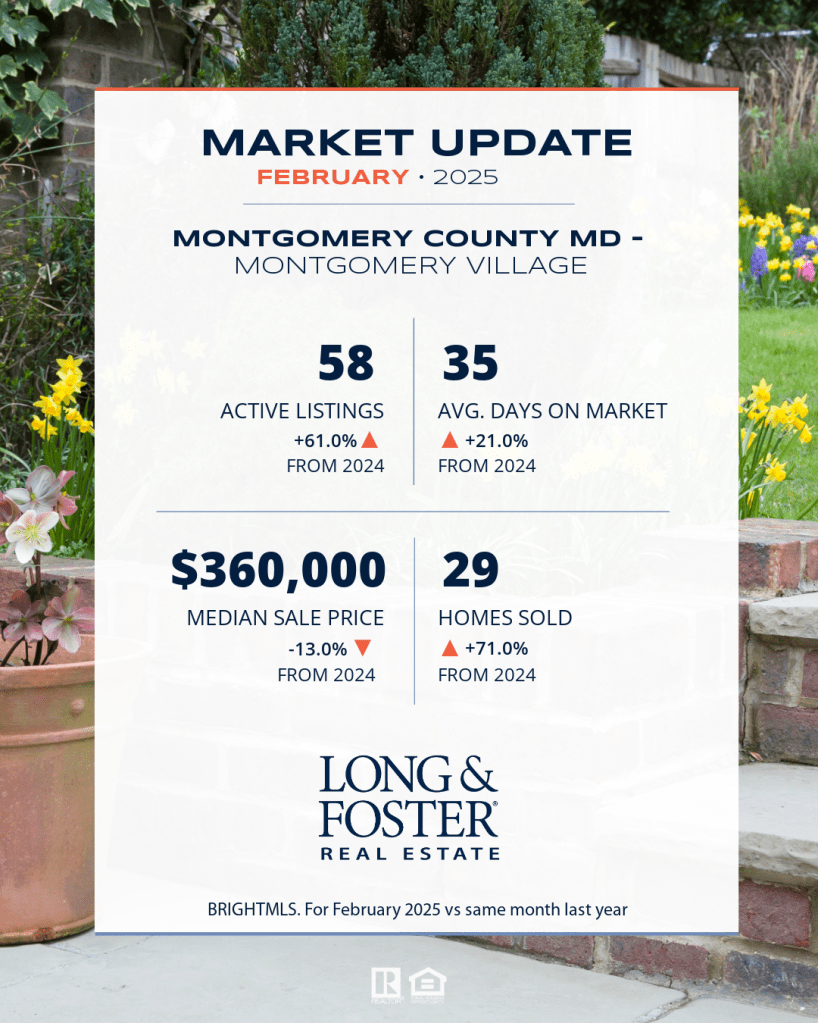

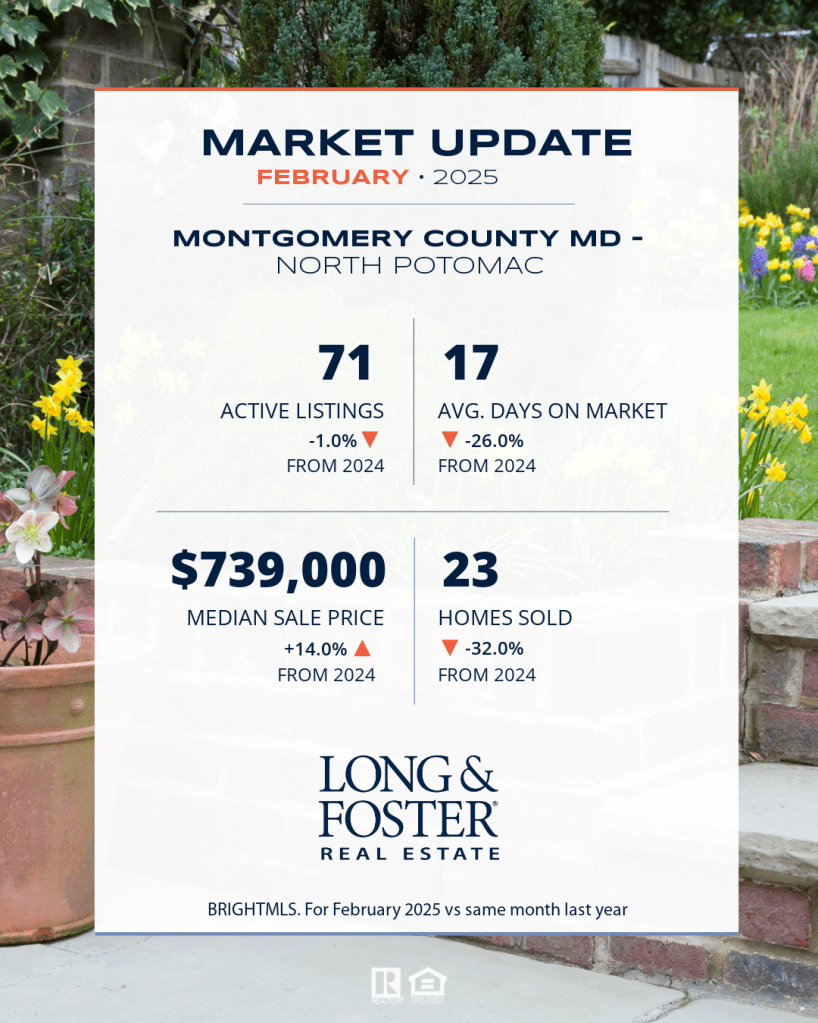

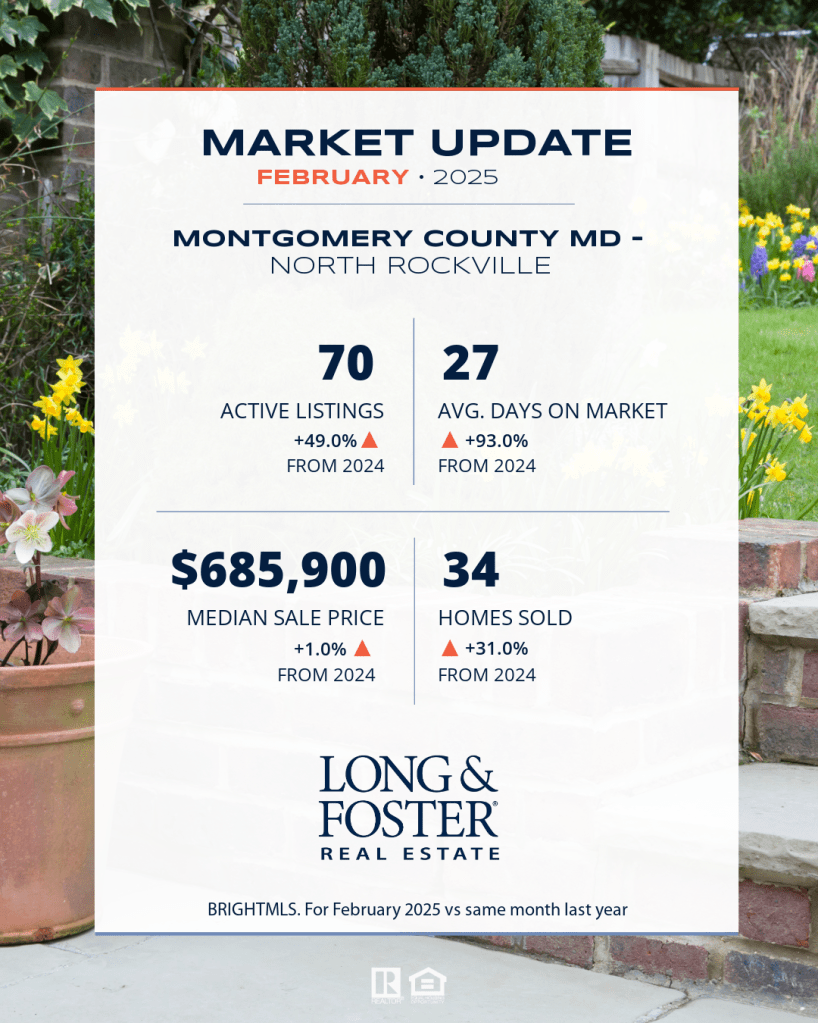

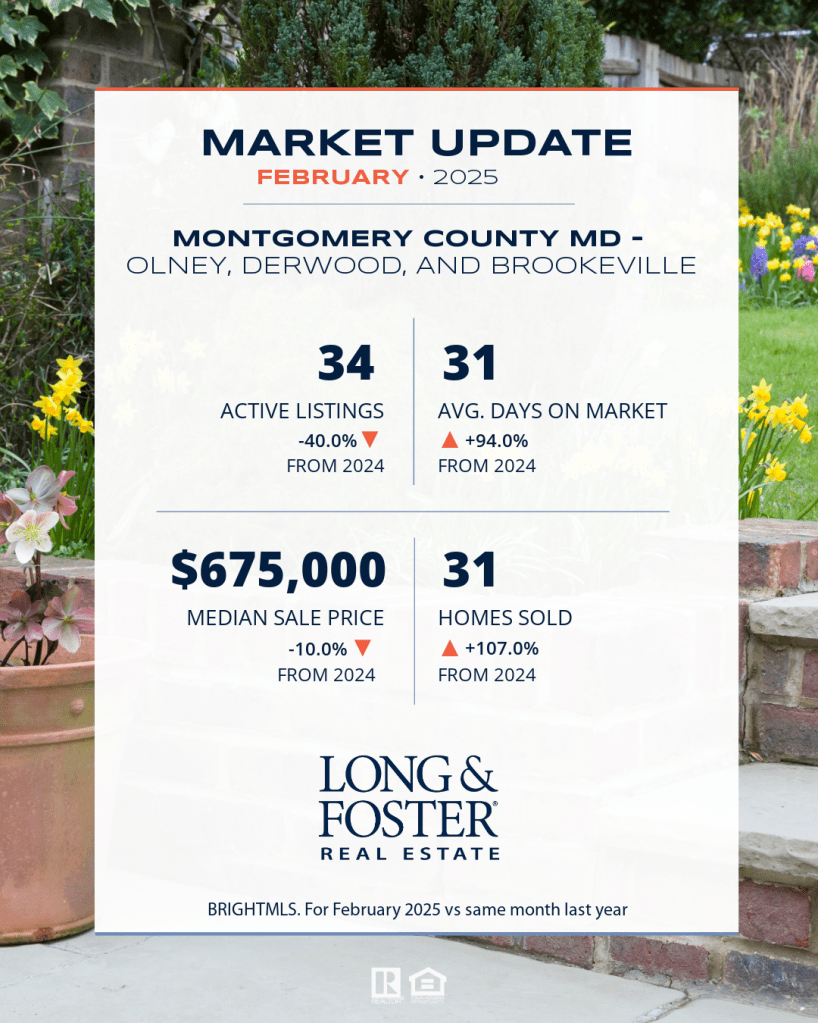

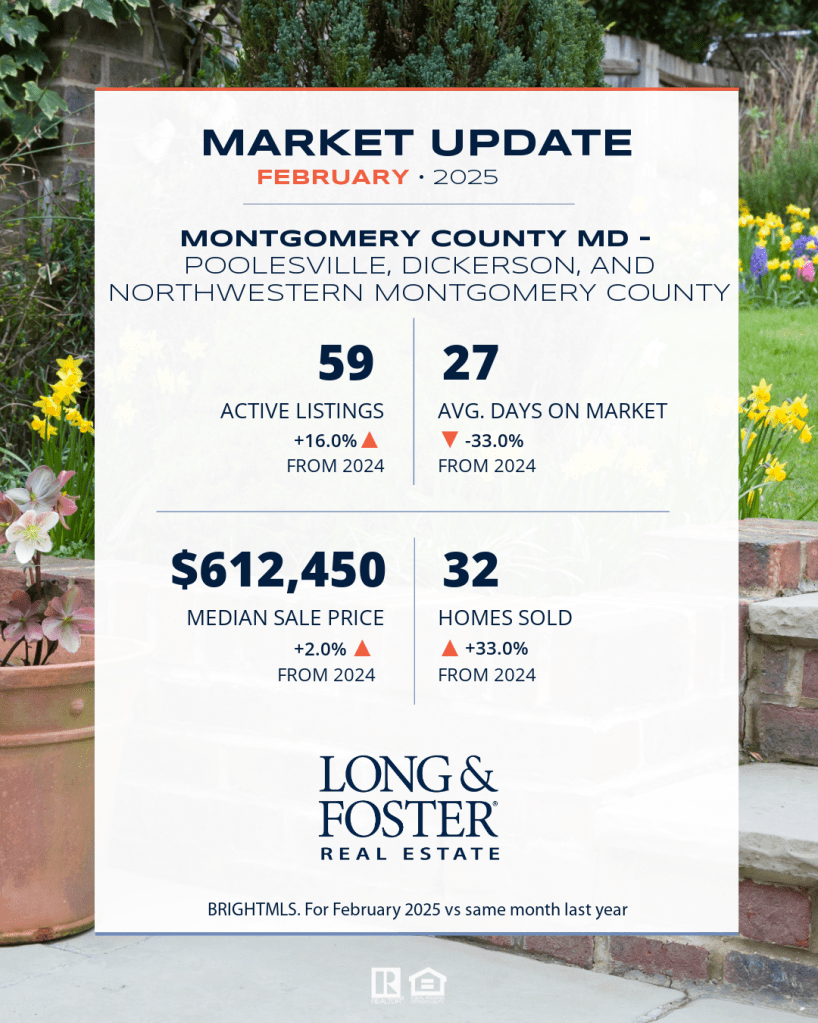

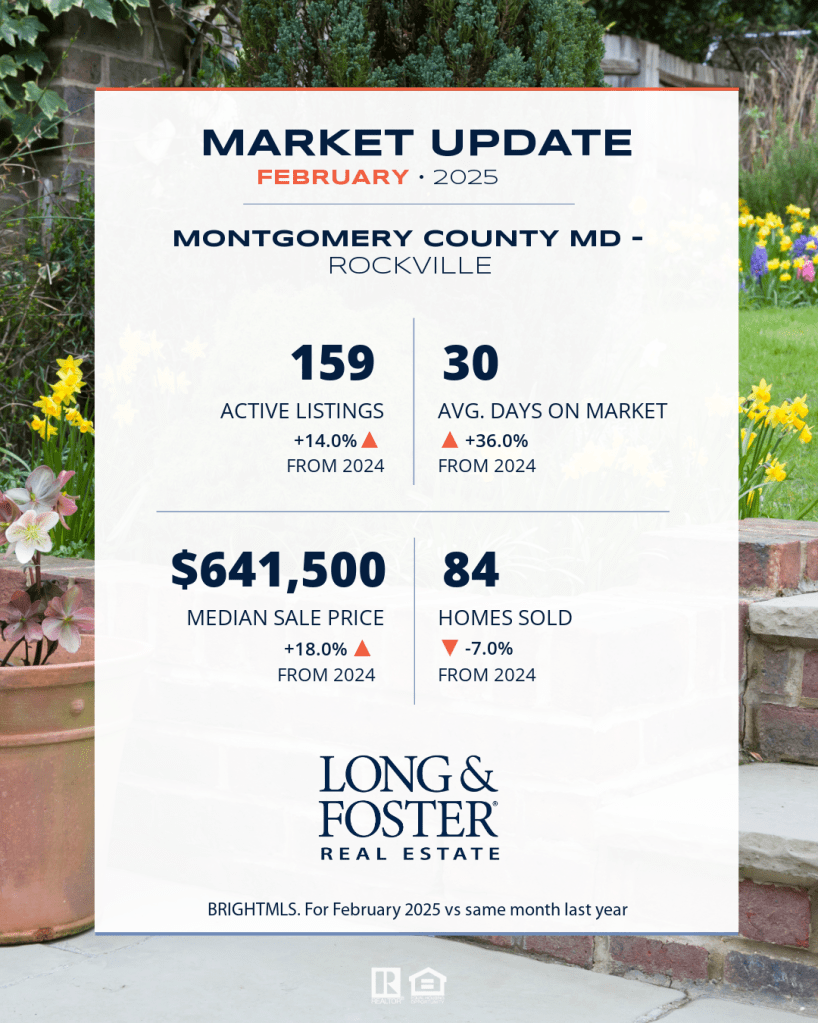

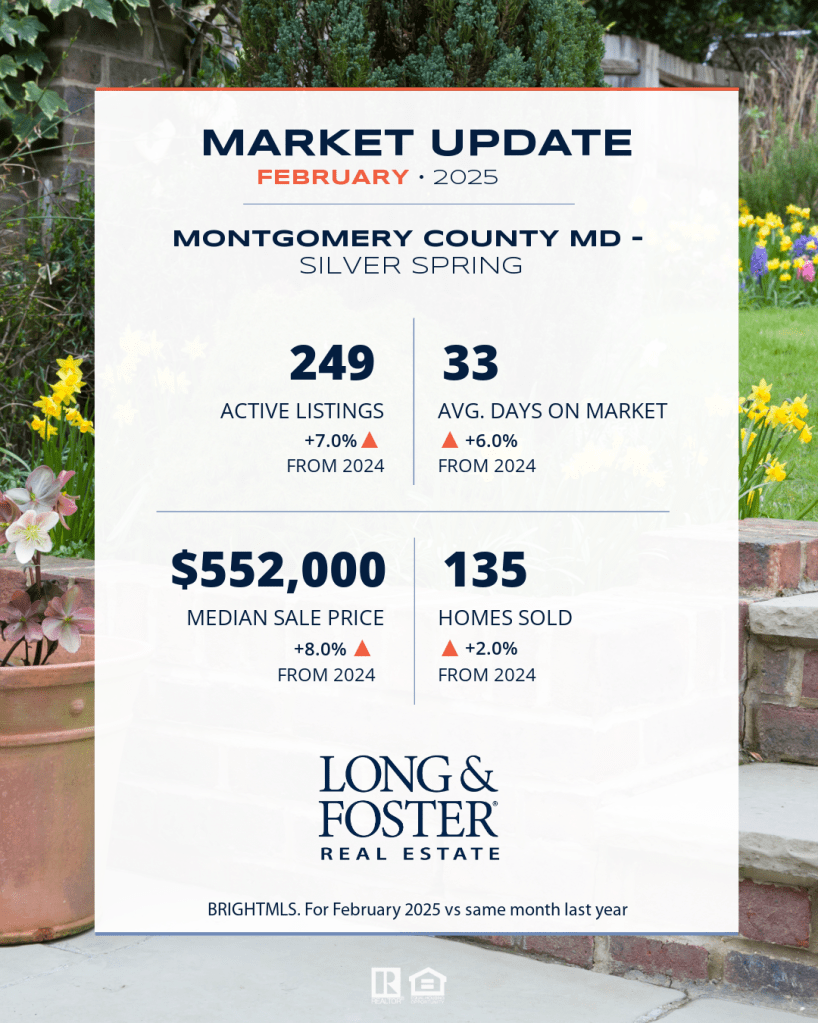

- Continued Price Appreciation. Home prices are still on the rise. The increases are less significant than in prior years. This moderate appreciation may ease the concerns of potential buyers. It suggests improvements in inventory and affordability.

- Varying Mortgage Rates. With mortgage rate fluctuations, it is a good idea to consult a mortgage consultant sooner rather than later. Thirty-year rates have remained below 7% almost all year. Locking in a rate now can be beneficial for your long-term plans.

- Example:

- At a 3% interest rate: For a $300,000 mortgage, a 30-year loan would cost about $1,265 a month.

- At a 6% interest rate: The same mortgage would increase to roughly $1,798 a month.

- Growing Inventory. Real estate conditions vary by location. There is an increase in the number of homes for sale in parts of the Mid-Atlantic and Northeast. If you’re interested in a specific market, please reach out. I can track inventory levels and keep you updated on any listed properties that meet your needs.

- Balanced Market. For the first time in years, experts predict a balanced market in 2025. This shift benefits both buyers and sellers after a long period during the pandemic when the market was dominated by sellers.

Real estate trends vary significantly from one area to another. If you would like more details about our local community, feel free to contact me. I am happy to provide a competitive market analysis for your home or share insights from our local market reports.

Plus, if you are house-hunting, consider attending Long & Foster’s Open House Weekend on April 26 and 27. You can find open houses near you here. Wishing you a happy spring.